Tax Governance and Operational Performance

Tax Governance

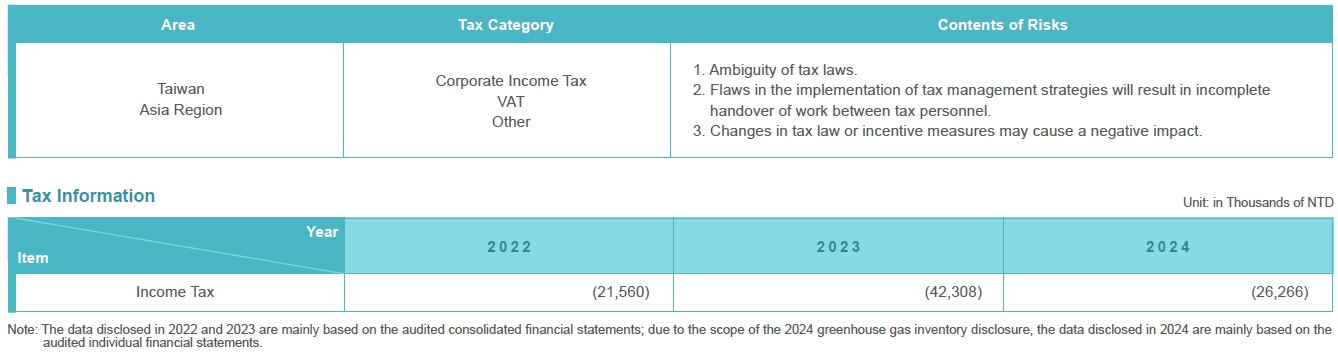

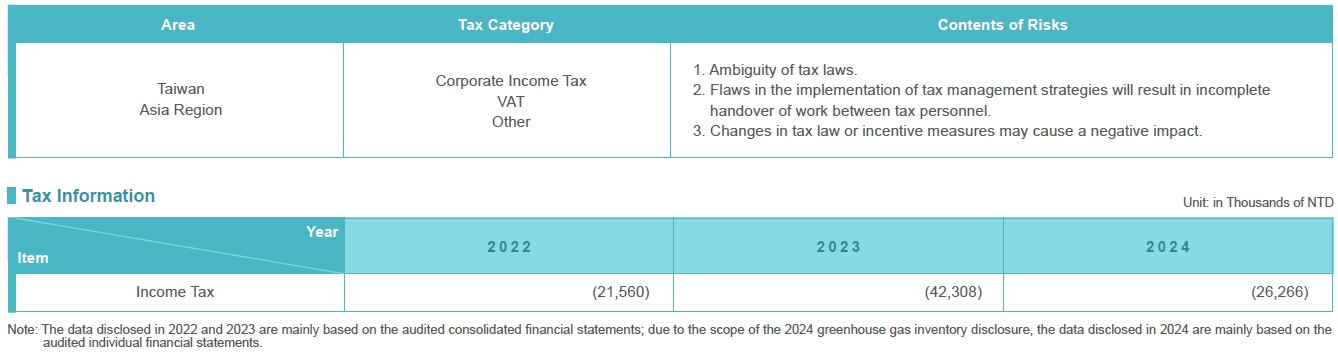

The principles of Brogent's tax governance policy and transfer pricing policy are in accordance with the Income Tax Act and Regulations Governing Assessment of Profit-Seeking Enterprise Income Tax on Non-Arm's-Length Transfer Pricing. Transactions between affiliated enterprises are handled in accordance with the principles of arm's length transactions, and the internationally recognized transfer pricing guidelines announced by the Organization for Economic Cooperation and Development (OECD). We do not use tax havens for tax planning for the purpose of tax

avoidance.

Brogent mainly operates and expands business in Taiwan and Asia. At the same time, we comply with the tax laws and regulations of the countries we operate in, and assesses potential tax risks. Under tax governance risk management, we actively respond to international trends in tax governance, support the government in implementing preferential tax policies, adhere to the principle of honest tax payment, and fulfill our obligations as a corporate citizen, in order to implement sustainable development and increase value for shareholders.

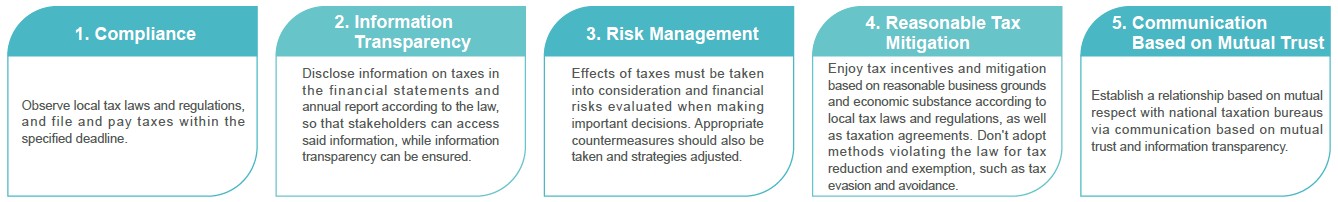

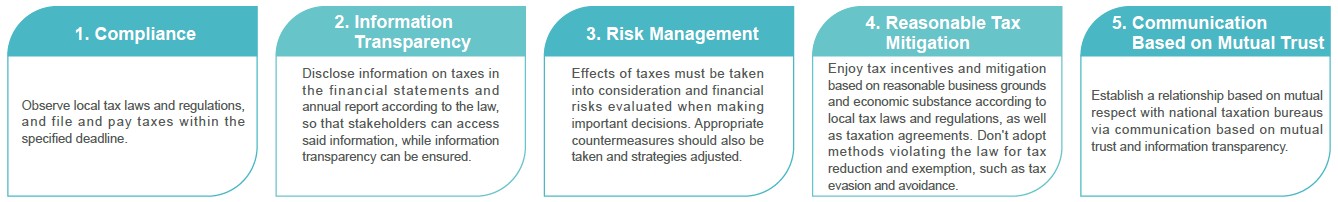

Brogent's board of directors is the highest decision-making unit for an effective tax risk management mechanism; The Finance Center is responsible for tax governance and implements the five principles of the tax policy. It also regularly reviews the implementation of tax management, and reports on relevant tax management to the board of directors every six months.

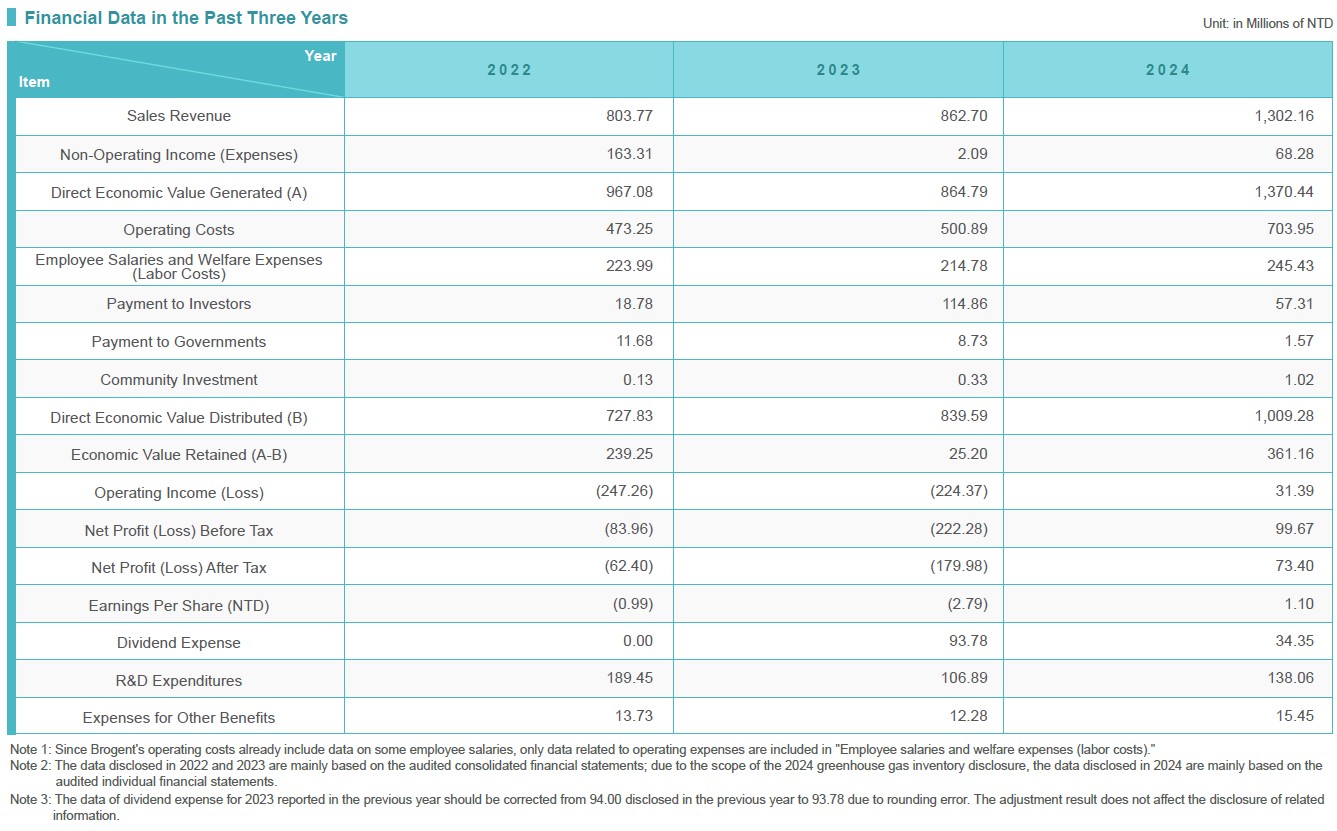

Operational Performance

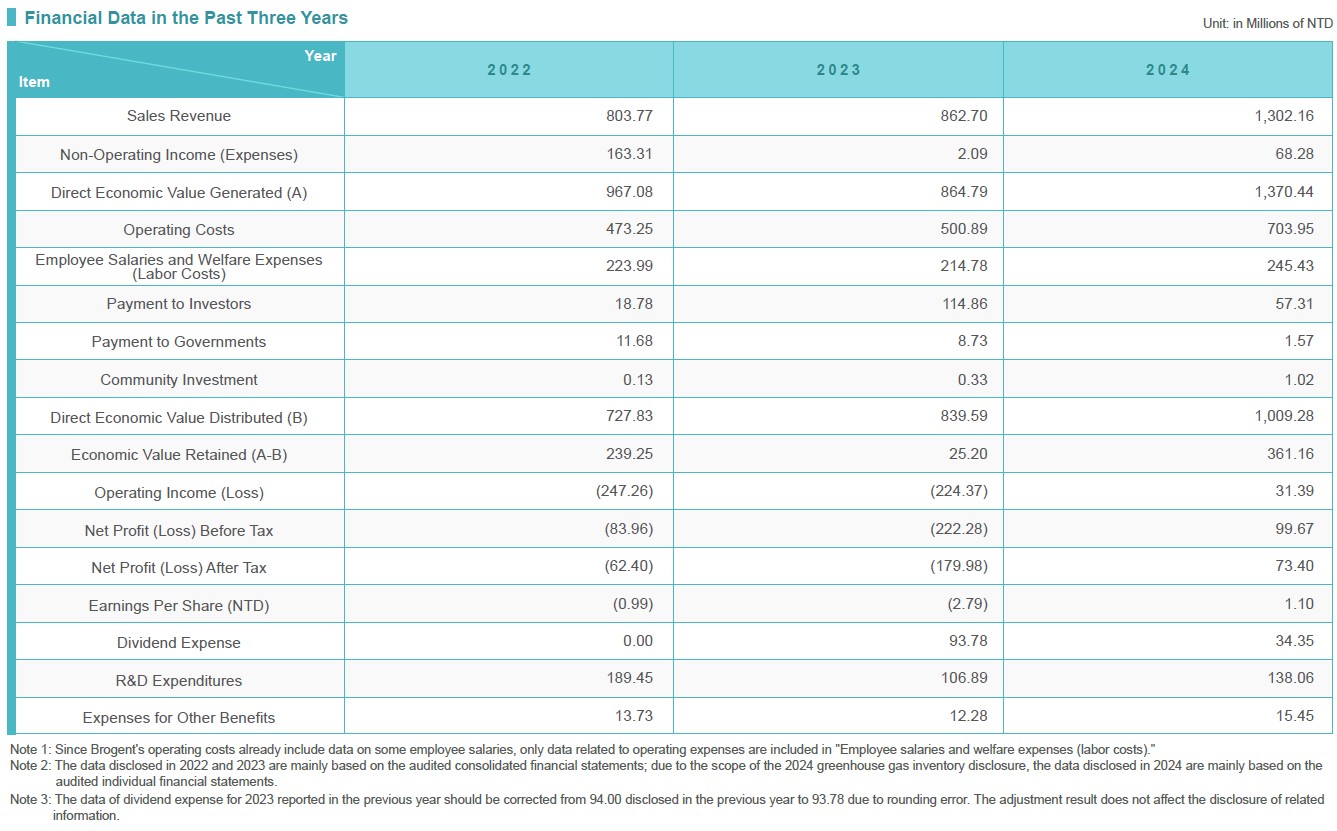

With the recovery of tourism, Brogent has opened a number of new rides around the world, such as FlyOver Chicago Flying Theater and flying theater in Thaiwoo, Zhangjiakou; however, Brogent's R&D team did not stop in 2024, we invested a considerable amount resources and R&D capabilities into product development, using innovative technologies to develop a wide variety of simulator rides to meet customers' diverse needs, providing customers with a full range of products and services. Brogent has launched the groundbreaking s-Ride flying theatre, interactive VR combat experience-Defend the Frontline, innovative 4D motion theater, the standing 4D theater and next-generation racing simulator. This simulator rides showcase Brogent's diverse technical strength in combining immersive simulation technology, artificial intelligence, VR and system integration, consolidating its existing market leadership with a diversified product line.

In addition to global market expansion, Brogent is rapidly developing its digital content library in 2024. By using advanced filming techniques and software like Unreal Engine and AIGC, the Company enhances production efficiency. For example, the launch of the "Volare Over Earth: Episode I – Africa", and "Attack on Titan: Declaration of War", which opened up more market opportunities with a rich digital content library. Moving forward, Brogent plans to integrate AI, virtual reality, and immersive imaging to create groundbreaking entertainment experiences, ensuring that its rich film content and diverse amusement products drive mutual growth and success.

In addition to the diverse business models mentioned above, Brogent continues to pay attention to the international situation and attaches even greater importance to risk assessment and management, so that it will be able to respond to the uncertainty of changes in the global economy and markets, as well as the potential impact of exchange rate and interest rate fluctuations on the Company's financial performance. We continued to strengthen hedging using foreign currencies in 2024, and carried out natural hedging under appropriate risk regulations, which further assisted the management of interest rates and exchange rates.

The principles of Brogent's tax governance policy and transfer pricing policy are in accordance with the Income Tax Act and Regulations Governing Assessment of Profit-Seeking Enterprise Income Tax on Non-Arm's-Length Transfer Pricing. Transactions between affiliated enterprises are handled in accordance with the principles of arm's length transactions, and the internationally recognized transfer pricing guidelines announced by the Organization for Economic Cooperation and Development (OECD). We do not use tax havens for tax planning for the purpose of tax

avoidance.

Brogent mainly operates and expands business in Taiwan and Asia. At the same time, we comply with the tax laws and regulations of the countries we operate in, and assesses potential tax risks. Under tax governance risk management, we actively respond to international trends in tax governance, support the government in implementing preferential tax policies, adhere to the principle of honest tax payment, and fulfill our obligations as a corporate citizen, in order to implement sustainable development and increase value for shareholders.

Brogent's board of directors is the highest decision-making unit for an effective tax risk management mechanism; The Finance Center is responsible for tax governance and implements the five principles of the tax policy. It also regularly reviews the implementation of tax management, and reports on relevant tax management to the board of directors every six months.

Operational Performance

With the recovery of tourism, Brogent has opened a number of new rides around the world, such as FlyOver Chicago Flying Theater and flying theater in Thaiwoo, Zhangjiakou; however, Brogent's R&D team did not stop in 2024, we invested a considerable amount resources and R&D capabilities into product development, using innovative technologies to develop a wide variety of simulator rides to meet customers' diverse needs, providing customers with a full range of products and services. Brogent has launched the groundbreaking s-Ride flying theatre, interactive VR combat experience-Defend the Frontline, innovative 4D motion theater, the standing 4D theater and next-generation racing simulator. This simulator rides showcase Brogent's diverse technical strength in combining immersive simulation technology, artificial intelligence, VR and system integration, consolidating its existing market leadership with a diversified product line.

In addition to global market expansion, Brogent is rapidly developing its digital content library in 2024. By using advanced filming techniques and software like Unreal Engine and AIGC, the Company enhances production efficiency. For example, the launch of the "Volare Over Earth: Episode I – Africa", and "Attack on Titan: Declaration of War", which opened up more market opportunities with a rich digital content library. Moving forward, Brogent plans to integrate AI, virtual reality, and immersive imaging to create groundbreaking entertainment experiences, ensuring that its rich film content and diverse amusement products drive mutual growth and success.

In addition to the diverse business models mentioned above, Brogent continues to pay attention to the international situation and attaches even greater importance to risk assessment and management, so that it will be able to respond to the uncertainty of changes in the global economy and markets, as well as the potential impact of exchange rate and interest rate fluctuations on the Company's financial performance. We continued to strengthen hedging using foreign currencies in 2024, and carried out natural hedging under appropriate risk regulations, which further assisted the management of interest rates and exchange rates.