Tax Governance

Brogent's tax governance policy and transfer pricing policy are based on my country's Income Tax Law and the "Regulations Governing Assessment of Profit-Seeking Enterprise Income Tax on Non-Arm's-Length Transfer Pricing". Transactions between related companies are based on regular transaction principles and follow economic cooperation. The internationally recognized transfer pricing guidelines promulgated by the Organisation for Economic Co-operation and Development (OECD) do not aim at tax avoidance and use tax havens for tax planning.

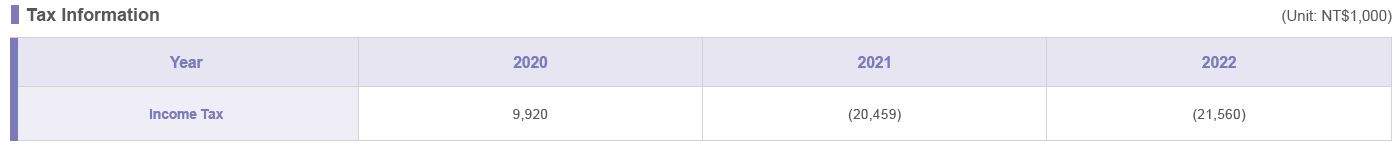

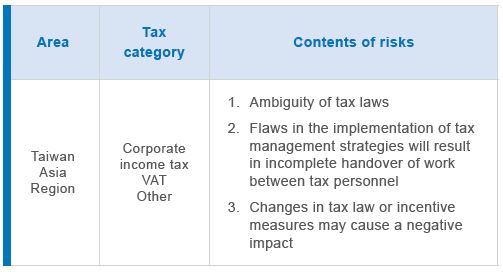

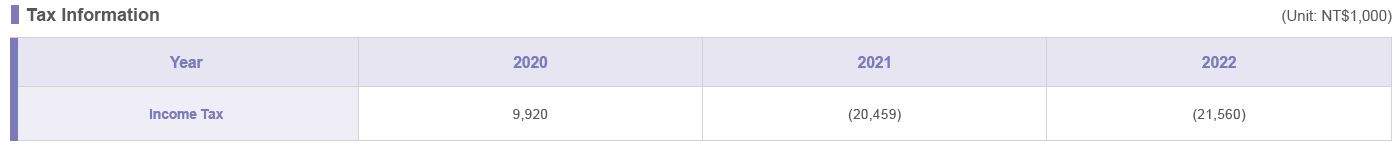

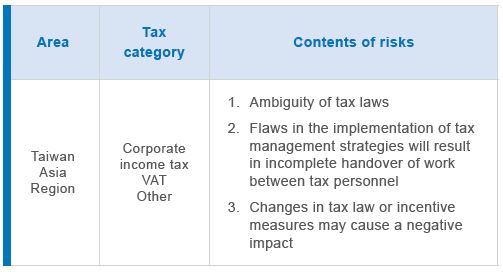

Brogent mainly operates and expands its business in Taiwan and Asia, and complies with the tax regulations of the country where business locations are located, assessing potential tax risks. We actively respond to international trends in tax governance under tax governance risk management, and support the government's tax preference policy. We uphold the principle of honestly paying taxes and fulfilling our duties as a corporate citizen, in order to implement sustainable development and increase value for shareholders.

Brogent's board of directors is the highest decision-making unit for an effective tax risk management mechanism; The Finance Center is responsible for tax governance and implements the five principles of the tax policy. It also regularly reviews the implementation of tax management, and reports on relevant tax management to the board of directors every six months.

Brogent mainly operates and expands its business in Taiwan and Asia, and complies with the tax regulations of the country where business locations are located, assessing potential tax risks. We actively respond to international trends in tax governance under tax governance risk management, and support the government's tax preference policy. We uphold the principle of honestly paying taxes and fulfilling our duties as a corporate citizen, in order to implement sustainable development and increase value for shareholders.

Brogent's board of directors is the highest decision-making unit for an effective tax risk management mechanism; The Finance Center is responsible for tax governance and implements the five principles of the tax policy. It also regularly reviews the implementation of tax management, and reports on relevant tax management to the board of directors every six months.