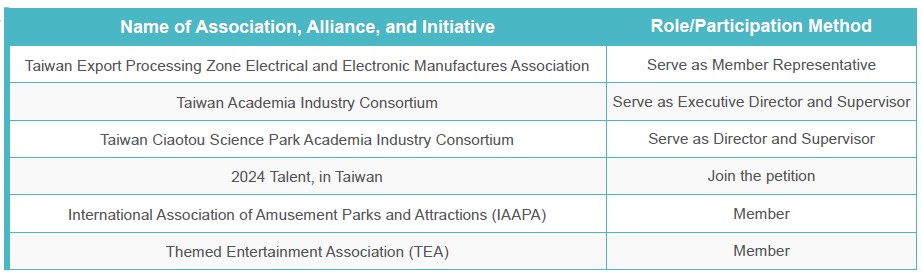

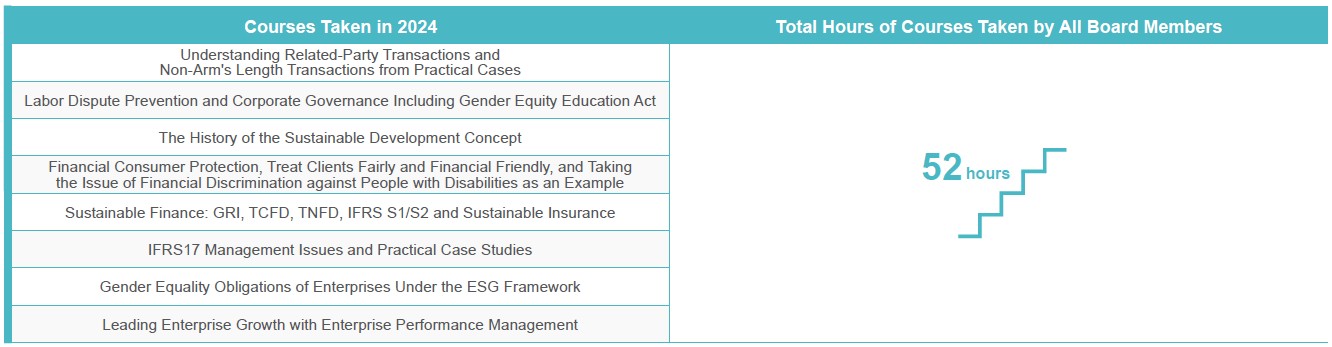

Corporate Governance

Company Organizational Chart

Brogent's highest governance body is the Board of Directors, which guides the Company's strategy and supervises the management and is accountable to the company and its shareholders. Functional committees have been set up under the Board of Directors, such as the Audit Committee, which is responsible for the execution of the audit function, and the Remuneration Committee, which is responsible for overseeing the policies of directors' and managers' compensation and related policies, and each of these functional committees submits the proposed resolutions to the Board of Directors for resolution. The highest-ranking executive of Brogent's management team is the Chairman, Mr. Chih-Hung Ouyang (also serves as General Manager). He is responsible for the overall management of the Company's business performance and decision-making on issues related to the economy, environment, people and human rights. He is also responsible for supervising the implementation of internal audits and internal controls, planning medium and long-term business strategies, directions for developing new businesses, and market strategies, and managing the operational performance of investee companies. Since Brogent's chairman and general manager are the same person, Brogent added an independent director to the board of directors in 2023 to enhance the independence and supervision of the Board of Directors and ensure sound corporate governance. Furthermore, Brogent has also established a Corporate Governance Officer to implement corporate governance. In addition to improving the effectiveness of the Board of Directors and functional committees, it also enhances information transparency to protect the rights and interests of investors.In the face of the rapidly changing international situation and market environment, Brogent adjusted its internal organizational structure in 2025 to adapt to challenges through more agile organizational operations. In addition to facing the surge of AI, the Company also attaches great importance to information security issues and risks, so it renamed the Information Technology Department to the "Intelligent Systems Center". In order to accelerate the product development process and actively respond to the market, the organizational structure of the R&D unit was adjusted to "T1 R&D Center", "T2 R&D Center" and "Intelligent Products Development Department" respectively.

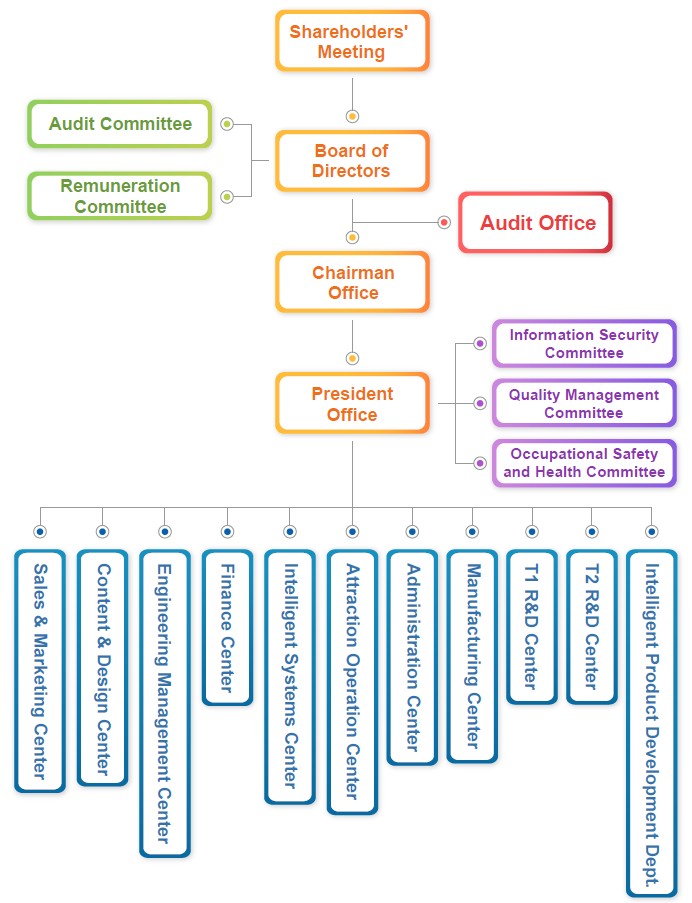

Board of Directors

▌Board Diversity Composition

The nomination and selection of Brogent's director candidates are based on the "Rules for Election of Directors" which are fair, just and open, and the candidate nomination system in accordance with Article 192-1 of the Company Act. The candidates' academic qualifications, professional background, integrity or relevant professional qualifications are evaluated. After the board of directors approves the resolution, the shareholders' meeting will select the director candidates from the list and adopt the cumulative voting method with single-name designation. The Board of Directors shall consist of seven to nine members, including at least 3 independent directors, who are elected for a term of three years and are eligible for re-election. The 2024 Board of Directors consists of 8 members with a term of 3 years. All of them are male and independent. Among them, 4 are independent directors, accounting for 50%. There are no spouses or relatives within the second degree of kinship among the directors. The age range of directors is 1 person aged 51-60 (12.5%), 6 people aged 61-70 (75%), and 1 person aged 71 or above (12.5%). There is 1 director who is a manager of the Company, accounting for 12.5%, demonstrating the soundness of the board structure. In addition, Brogent requires managers and directors to meet the highest ethical standards of integrity, and sets forth the duties of a good administrator in the Ethical Corporate Management Best Practice Principles, the Codes of Ethical Conduct for Directors and Managerial Officers, and the Operating Procedures for the Prevention of Insider Trading.

Brogent clearly stipulates in the "Corporate Governance Best Practice Principles" that the diversity of Board members must be taken into consideration, and that there are no restrictions on gender, age, nationality, and culture. Therefore, the diversity of the members of the 8th Board of Directors all have professional skills in operational identification, business management, leadership decision-making, crisis management, industry knowledge and international market perspectives, and cover different aspects of practical and academic research professional backgrounds such as accounting, industry, finance, technology and law. Two directors have a professional background in financial accounting, accounting for 25% of all directors; six directors have rich professional backgrounds in industry and technology, accounting for 75% of all directors; and one director has a professional background in law, accounting for 12.5% of all directors.

Although the current Board of Directors is composed of male directors, the Company has set a target ratio of gender diversity among board members in order to promote diversity and gender balance on the Board of Directors. In the future, the Company will give priority to seeking female board candidates with professional capabilities and leadership experience, and will be included in the 2026 Board of Directors' re-election. The Company expects to have at least one female director seat on the Board to strengthen corporate governance and decision-making diversity. Please see below for the list of board members.

▌Operation of the Board of Directors

Brogent's Board of Directors supervises the Company's operations, formulates company strategies and policies, identifies operational risks, and plans the development direction of ESG by exercising the powers conferred by the Company Act, Articles of Incorporation, and resolutions of the shareholders meeting. In 2024, a total of 6 meetings were held, which complied with the requirement of holding at least one regular meeting every quarter, with an average attendance rate of 97.92%. A total of 14 key major events (such as corporate governance, integrity management, energy and greenhouse gases, sustainable development, etc.) were communicated with the highest governance body. Please refer to the "II. Corporate Governance Report" section of the "2024 Annual Report", pages 50 to 51, or the Company's website for the relevant important resolutions of the Board of Directors.

In addition, Brogent continues to be committed to the implementation of sustainable development. It reports the implementation of the "Group Greenhouse Gas Inventory and Assurance Schedule" to the Board of Directors every quarter, and reports to the Board of Directors at least once a year on the implementation of the Company's sustainable development promotion, integrity management, intellectual property management, and information security management.

All directors explained the reason for recusal for agenda items of Board meetings and functional committee meetings in which they were an interested party, and they recused themselves from discussion and voting on the agenda items, in order to ensure that they avoid and mitigate any conflicts of interest. Please refer to the "II. Corporate Governance Report" section of the "2024 Annual Report", page 20 and page 24.

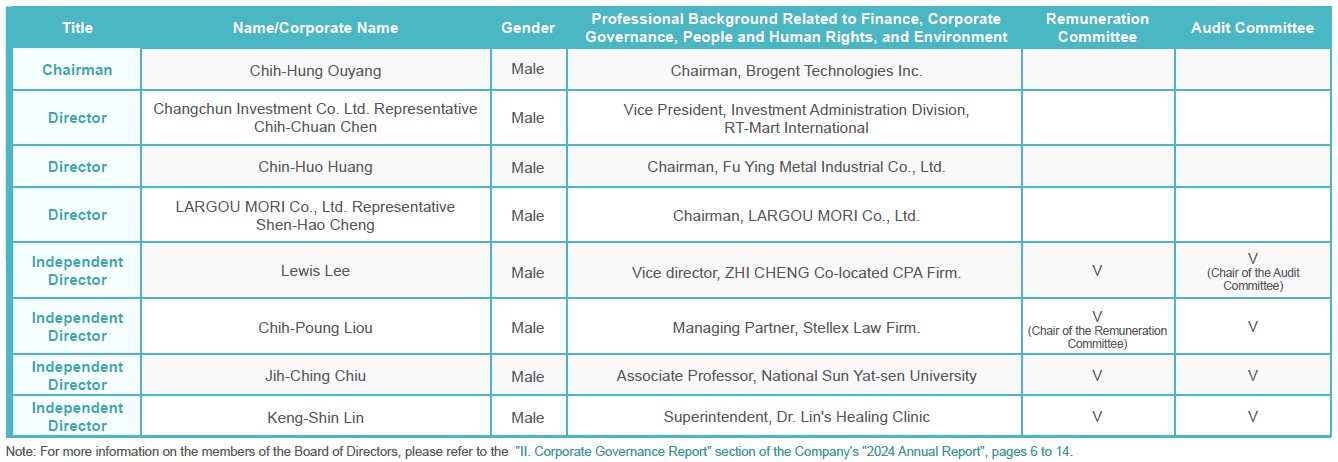

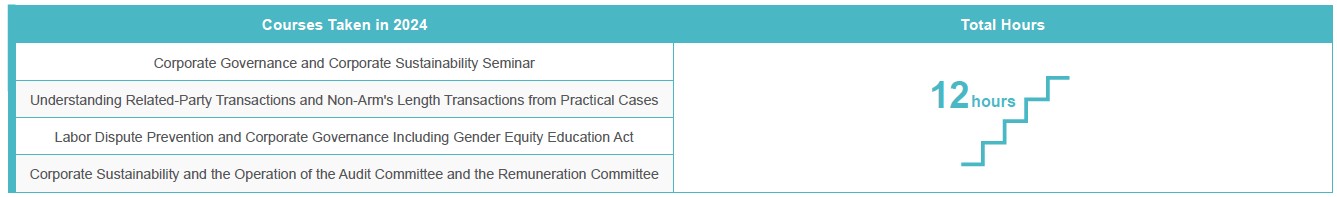

▌Continuing Education of Directors

Brogent handles continuing education of the Board of Directors in accordance with the "Directions for the Implementation of Continuing Education for Directors and Supervisors of TWSE Listed and TPEx Listed Companies." Directors received a total of 52 hours of continuing education in 2024, on average each director received 6.5 hours of continuing education. Through relevant courses, we continuously enhance the directors' understanding of regulatory amendments, ESG sustainable development issues and emerging issues, so as to strengthen well-rounded competencies of board members and collective intelligence in sustainable development, and thus improve the effectiveness of corporate governance.

Operations of Functional Committees

▌Remuneration Committee

The Remuneration Committee and its Charter were established in accordance with the "Regulations Governing the Appointment and Exercise of Powers by the Remuneration Committee of a Company Whose Stock is Listed on the Taiwan Stock Exchange or the Taipei Exchange." The Remuneration Committee supervises the Company's remuneration system for directors and managers, faithfully performs its duties, and submits proposals to the Board of Directors for review. Meetings are held at least twice a year and whenever necessary. Three meetings were held in 2024, with an average attendance rate of 100%. For details on members attendance, operation status and resolutions, please refer to the "II. Corporate Governance Report" section of the "2024 Annual Report", pages 33 to 35 or the Company website.

The remuneration standards for Board members or senior executive of Brogent are based on the "Administrative Measures for the Remuneration of Directors and Managers." The Company's annual performance evaluation for managers is based on their contribution to financial indicators, quality and risk management, and leadership and management performance. Raises and variable salaries of managers are linked to business performance. Information on remuneration is disclosed in the annual report for review by all Brogent stakeholders. Furthermore, the remuneration of Brogent's directors and senior executive is determined and supervised by the Remuneration Committee, and submitted to the Board of Directors for approval, so as to prevent directors and senior executive from engaging in behavior that exceeds the Company's risk appetite. In response to the trend of sustainable development and the promotion of the Company's internal sustainable management strategy, Brogent will incorporate sustainable development performance into the remuneration evaluation mechanism of directors and senior executive in the future to strengthen the overall sustainable governance effectiveness.

Brogent's Audit Committee and Remuneration Committee are formed by all independent directors and are independent. Brogent does not have a clawback mechanism. For information on the remuneration of directors, president and vice presidents, please refer to the "II. Corporate Governance Report" section of Brogent's "2024 Annual Report", pages 17 to 19.

▌Audit Committee

In order to strengthen corporate governance and operations, Brogent has established an Audit Committee to oversee the fair presentation of the Company's financial statements, the independence of CPAs, the effective implementation of the Company's internal control, the Company's compliance with relevant laws and regulations, and the control of the Company's existing or potential risks, etc. The Audit Committee will submit the relevant resolutions to the Board of Directors for approval, which will be convened at least 6 times a year and may be convened meetings at any time as necessary. Six meetings were held in 2024, with an average attendance rate of 100%. For details on members attendance, operation status and resolutions, please refer to the "II. Corporate Governance Report" section of the "2024 Annual Report", pages 23 to 25.

In addition to exercising its supervisory duties through the Audit Committee, in order to enhance operational efficiency and ensure effective communication, independent directors hold separate meetings each year with internal auditing officer and the CPAs. Two communication meetings have held in 2024. For details of the separate communication, please refer to the Corporate Governance-Internal Audit page in the investor area of the Company's website.

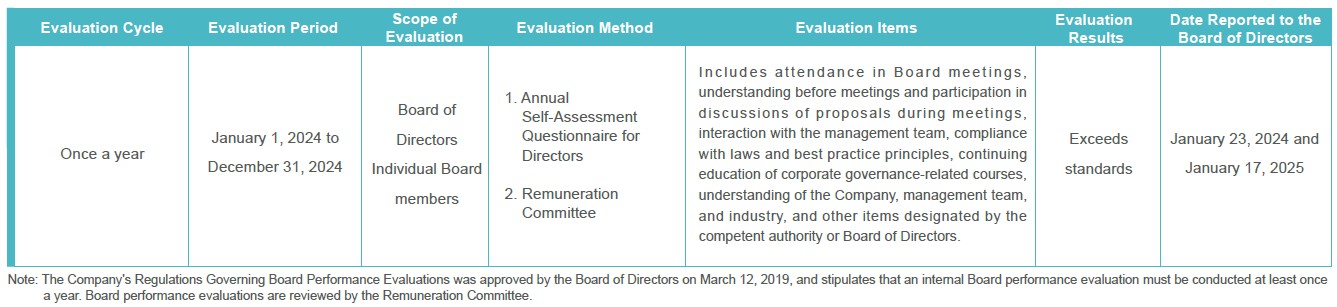

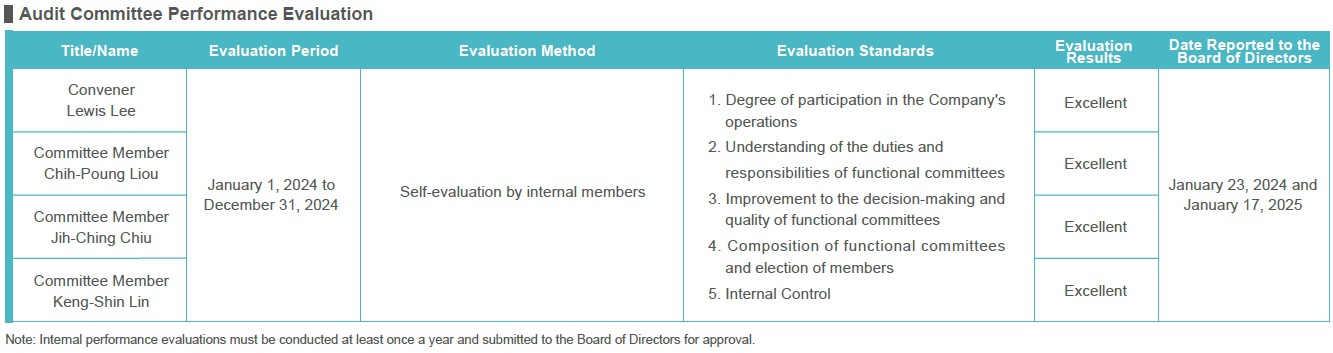

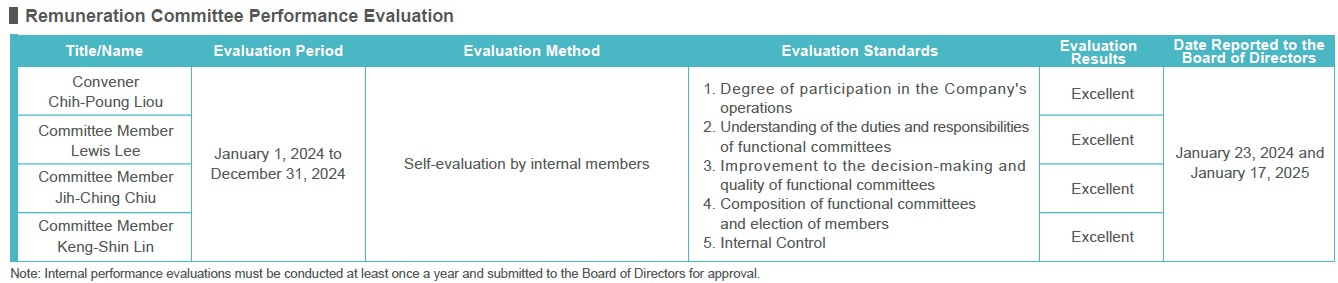

Board of Directors and Functional Committee Performance Evaluations

Internal self-evaluations are conducted for the performance of the Board of Directors and functional committees (Audit Committee and Remuneration Committee). The self-evaluation results were "exceeds standards" and "excellent," which shows that Brogent's Board of Directors and functional committees are functioning properly and operating efficiently, and the results were reported to the Board of Directors on January 23, 2024 and January 17, 2025. Details of the performance evaluations are described below:

▌Performance Evaluation of the Board of Directors

▌Functional Committee Performance Evaluation

Implementation of Corporate Governance

Brogent established its corporate governance framework and carries out related tasks in accordance with the Company Act, Securities and Exchange Act, and other relevant securities management regulations, as well as the "Corporate Governance Best Practice Principles," "Sustainable Development Best Practice Principles," and "Ethical Corporate Management Best Practice Principles." We protect the rights and interests of investors, give full play to the functions of the Board of Directors and functional committees, and increase information transparency on this basis. The Company's Chief Financial Officer Sui-Chuan Lin serves as the corporate governance officer, and her main duties include:

- Develop company policies and an organizational framework able to effectively ensure the independence of the Board of Directors, company transparency and regulatory compliance, and effective implementation of internal audits and controls.

- Report on the status of corporate governance operations to the Board of Directors, directors, and functional committees. Ensure that the Company's shareholders meetings and Board meetings are being convened pursuant to relevant laws and regulations, as well as the Company's corporate governance best practices.

- Consult directors' opinions before Board meetings to plan and draft the agenda, notify all directors to attend at least 7 days in advance, and provide sufficient meeting materials to help directors understand the content of related issues. Advance notice shall be provided to the relevant parties if any agenda items to be discussed constitute a conflict of interest and a recusal is required.

- Set a date for the shareholders meeting each year within the legally-required period. A notice of meeting, meeting agenda handbook, and meeting minutes shall be prepared and submitted before this period, after any amendments to the Articles of Incorporation or an election of directors.

- Review material information on important resolutions of the Board of Directors released after Board meetings and shareholders meetings, and ensure the legality and correctness of material information to ensure that investors have equal access to transaction information.

- Report new amendments to regulations relevant to the Company's business operations or corporate governance to directors.

- Plan and arrange for annual director training relevant to the industry in which the Company does business and based on each director's educational and professional background.

- Provide required company information to directors, and maintain smooth communication between directors and executives in charge of each company department.

- Assist in arranging for meetings and communication between independent directors and executives responsible for internal audits or certified public accountants, allowing independent directors to understand the Company's financial affairs.

- Other areas of responsibility as defined in the Company's Articles of Incorporation or company contracts.

Implementation Plan for IFRS Sustainability Disclosure Standards

In response to the international trend of financialization of sustainability information and in accordance with the "Taiwan's Roadmap for Aligning with IFRS Sustainability Disclosure Standards" issued by the Financial Supervisory Commission R.O.C. (Taiwan) on August 17, 2023, and referring to the alignment with IFRS Sustainable Disclosure Standards outlined in the dedicated roadmap for listed and OTC companies, as provided in the "Dedicated Section for IFRS Sustainability Disclosure Alignment". Brogent will apply IFRS Sustainable Disclosure Standards in 2028 and disclose it in the Company's annual report in 2029. In order to smoothly align with the IFRS sustainability disclosure standards, Brogent will convene relevant departments to research and discuss the differences between the IFRS sustainability disclosure standards and Brogent's sustainability information disclosure, and gradually improve it to meet the disclosure requirements. The specific implementation schedule is to establish a standard implementation working group in 2026, complete the identification of sustainability-related risks and opportunities and related financial analysis in 2027, voluntarily disclose sustainability information in the annual report in advance in 2028, and officially disclose a special chapter on sustainability information in the annual report in 2029.